The company directors’ guide to insolvency solutions

Running a business is hard. Sometimes, despite your best efforts, you may end up in a difficult financial position. This can be an incredibly stressful time, with pressure on you to turn things around while considering how to manage your responsibilities to your employees, customers and suppliers.

The good news is that insolvency doesn’t have to mean the end. There are insolvency solutions that could help you repay debts in full or in part over time, enabling your business to reach a compromise with creditors so that you can continue trading.

This guide aims to help worried business owners better understand insolvency. We’ll walk you through the common causes of insolvency, signs to watch out for and the solutions that might be available to an insolvent company.

Our goal is to provide practical guidance and reassurance during this difficult period. There are options available to help you resolve company debts and get a fresh start.

What is insolvency?

Insolvency refers to the position of a business when it’s unable to pay its debts in full, when they’re due. Even businesses with assets can be insolvent if they can’t afford their regular outgoings and liabilities at the time they’re due to be paid.

Some indicators of insolvency include:

- Running out of cash and being unable to access new funding

- Defaulting on loan or debt repayments

- Payments to suppliers bouncing or being missed

- Struggling to pay employee wages on time

Being insolvent doesn’t necessarily mean the end of the road for your business. There are informal and formal insolvency processes that can help get your company back on track. But the sooner you seek professional advice, the more options will be available. Ignoring the problem will only make things worse.

Get free, confidential advice today from our licensed insolvency practitioners and business rescue experts.

Common causes of insolvency

Most businesses are forced to close due to preventable issues that can be overcome successfully if they’re caught in time. It’s often a combination of factors building on one another that lead to insolvency, rather than one single cause.

Economic downturn

An economic recession and unfavourable conditions, like increased commodity prices, can put immense financial pressure on businesses. If demand falls sharply, companies may find it hard to cover their operating costs.

Poor financial management

Inadequate cash-flow management, high debt levels, excess stock or assets, and poor budgeting can slowly erode the financial health of a business. Taking on too much risk or making business decisions that turn out to be misjudged can also impact a business’ solvency.

We’ve created a free, step-by-step guide to creating a cash-flow forecast, designed especially for company directors.

Expanding too quickly

Rapid business growth may seem like a positive move. But it can be detrimental if the expansion is too fast or requires significant upfront costs and investment. The existing infrastructure may not be equipped to scale up so quickly.

Unforeseen events

Natural disasters such as flooding, accidents or theft can result in significant losses and liabilities beyond what a business can handle. Lack of insurance or contingency planning makes it hard to absorb the financial impact.

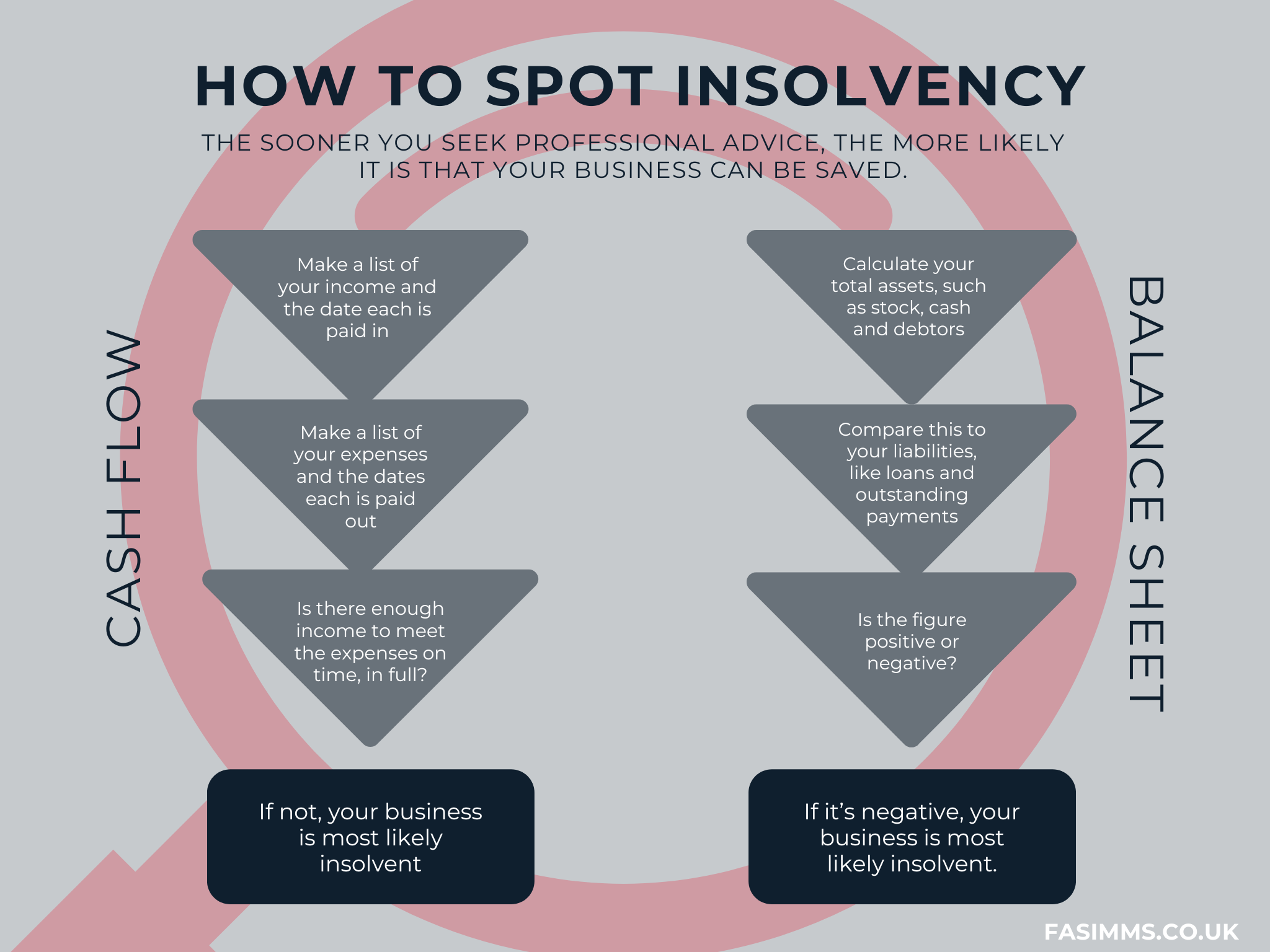

Signs your business may be insolvent

One of the clearest signs that your business may be heading towards insolvency is the inability to pay suppliers, employee wages, rent or utility bills. If you find your business is struggling to pay these debts, it’s time to seek professional help.

Another indicator is if your suppliers start putting your account on stop or limiting your credit. When suppliers do this, it shows they have concerns about your ability to pay and don’t want to risk taking on more debt. If several suppliers start tightening your credit terms, it suggests there are serious issues.

You may also get threats of enforcement action from HMRC if you have VAT arrears. HMRC is the UK’s biggest creditor and has been known to take serious action against non-payers. However, it’s also willing to arrange payment terms, if you act early. This is something our licensed insolvency practitioners can help you with.

How a licensed insolvency practitioner can help

If you’re worried about insolvency, it’s important to seek help from licensed insolvency practitioners as soon as possible. Insolvency practitioners are qualified professionals with extensive training and experience in insolvency law and procedures. It’s our job to guide you through from start to finish.

- We give expert advice

The insolvency industry is responsible for saving 1,000s of businesses and 10,000s of jobs every year. Sometimes this is simply a matter of us getting to know your business model and helping you to implement changes that bring you back into profit.

- We liaise with creditors & HMRC

We’re experienced in creditor negotiations and can mediate to get the best possible terms for the repayment of your business debts – including liaising with HMRC. This can save you from stressful, sometimes heated conversations.

- We create a rescue or recovery plan

We often work with business owners to put in place business changes designed to bring the business out of insolvency. This is anything from looking at business modelling to working out informal repayment plans with creditors.

- We handle legal processes

Declaring insolvency and using a formal insolvency process involves a lot of work. A licensed insolvency practitioner will handle it all for you, taking care of the legal filings and compliance on your behalf and representing you with creditors. This takes the burden off you.

Speak to our licensed insolvency practitioners and business rescue experts today, for free and confidential advice about your situation.

Possible insolvency solutions

If your business is struggling with debt, there are several legal insolvency solutions that could help you get back on track. This is a brief overview of the most common insolvency solutions which you may have read about in the media or heard about from your research.

Company Voluntary Arrangement (CVA)

A CVA is a deal between a company and its creditors to pay back part or all of its debts over time. It involves the appointment of a licensed insolvency practitioner who’ll put forward a proposal to creditors. If the proposal is approved, creditors cannot take legal action to recover their debts during this time.

Administration

Administration gives a company breathing space from creditors’ demands and legal action. It allows the administrator (who needs to be a licensed insolvency practitioner) time to work with the directors on plans to raise funds to pay some of the debt and bring the company back into profitability.

Liquidation

Liquidation involves the appointment of a licensed insolvency practitioner to sell the company’s assets and distribute the proceeds to creditors. Any remaining assets after creditors are paid will go to the shareholders. While liquidation is often considered as a last resort, because the company ceases to exist afterwards, it doesn’t always mean the end of a business. In some circumstances, we can help you start again after your company closes.

If you’d like to know more about liquidation, download our simple guide to liquidation, created for company directors who are assessing their business’ future.

How to get help for your business

We know how stressful and overwhelming financial struggles can be. Please know that you’re not alone. Many businesses face periods of insolvency but go on to recover and thrive again, with the proper support.

Our licensed insolvency practitioners have helped thousands of clients find the right solutions to resolve insolvency, relieve debt and restart their businesses. With tailored advice and guidance, many emerge stronger than before.

We offer free, confidential consultations so that we can assess your situation and give you the options available to you. Our goal is to provide the professional support you need and guide you through to a more profitable future.

Take the first step by getting in touch today. We’re here to listen without judgement and provide a clear path forward.